A statement of retained earnings is a financial document that outlines the changes in a company’s retained earnings over a specific accounting period. It reveals the movements in earnings retained within a business for reinvestment or future use rather than being distributed to shareholders as dividends. A company’s retained earnings balance can be found on the shareholder’s equity section of the balance sheet (one of the 3 core financial statements), which can be found in the company’s annual report or website.

Preparing for Change: Adapting to New Financial Reporting Standards

- After the accounting period ends, the company’s board of directors decides to pay out $20,000 in dividends to shareholders.

- We can find the dividends paid to shareholders in the financing section of the company’s statement of cash flows.

- You can find these figures on Coca-Cola’s 10-K annual report listed on the sec.gov website.

- You can find the amount on the balance sheet under shareholders’ equity for the previous accounting period.

- Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders.

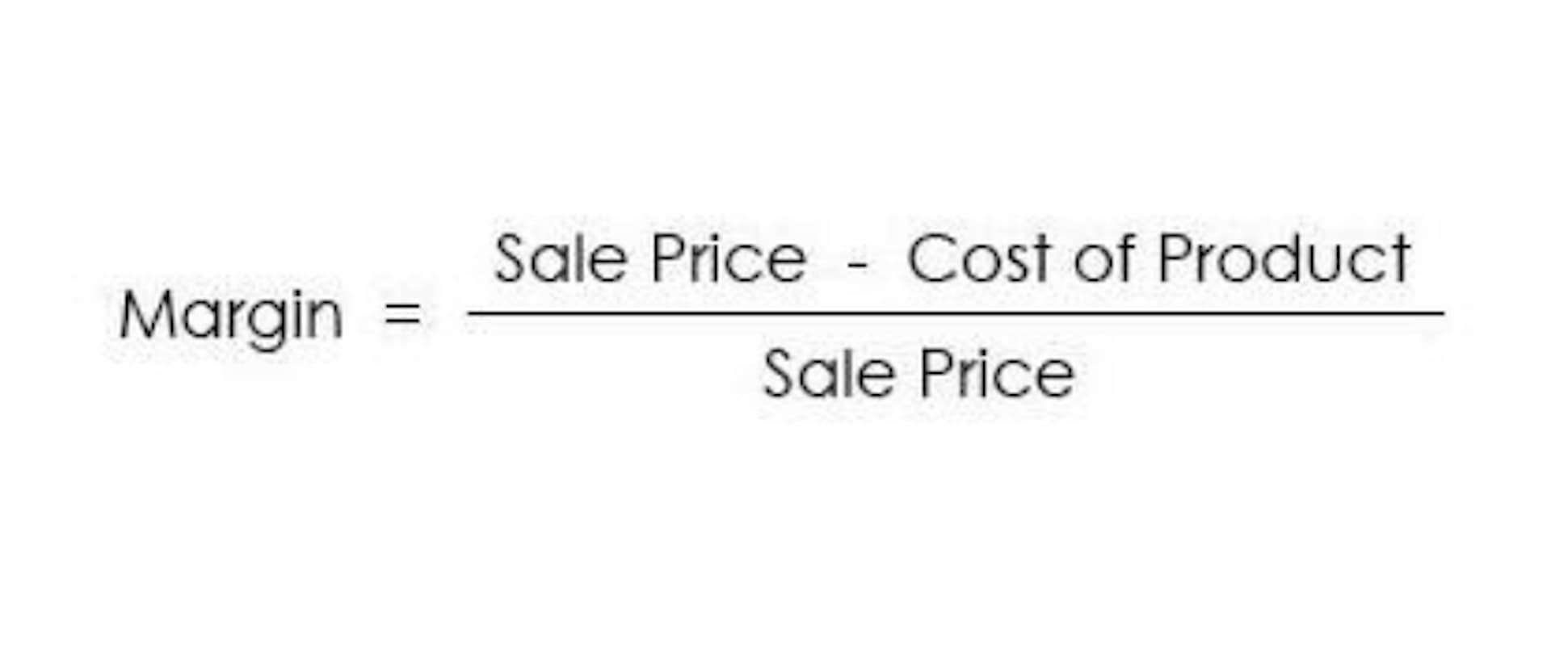

Net income represents the company’s profits after all expenses and taxes have been deducted. If a net loss occurs, instead of adding, it should be deducted from the retained earnings balance. If a company is profitable and decides to maintain a portion of its profits, it will credit the Bookkeeping for Etsy Sellers retained earnings account. On the other hand, if a company incurs a loss or distributes dividends to shareholders, the retained earnings account is debited. This reflects the accounting principle that increases in equity, such as profits kept within the company, and credits, while decreases in equity, such as losses or dividends, are debits.

Retained Earnings Strategies for Different Business Stages

Imagine a reservoir of funds, steadily growing with each fiscal period, held back by a company for future investment, debt reduction, or as a cushion against unforeseen financial challenges. This reservoir is known as retained earnings, a pivotal component of shareholder equity that reflects a firm’s financial health and strategic understanding. Retained earnings are a business’s remaining earnings after paying all of its direct and indirect expenses, income taxes, and dividends to shareholders. The equity stake in the company can be used, What is bookkeeping for example, to fund marketing, R&D, and new machinery purchases. The statement of retained earnings examples show how the retained earnings have changed during the financial period. This financial statement provides the beginning balance of retained earnings, ending balance, and other information required for reconciliation.

Are retained earnings a debit or credit?

It’s easy to mistake retained earnings for an asset because companies use them to buy inventory, equipment, and other assets. But a retained earnings account is reported on the balance sheet under the shareholders’ equity, so they’re treated as equity. A hefty retained earnings balance screams financial health and smart management to investors and creditors. Companies with a robust stash of retained earnings are the agile ninjas, ready to pounce on opportunities, invest in innovation, and survive downturns better than their debt-laden counterparts. Retained earnings are like the treasure trove of a business’s profits that isn’t thrown at shareholders as dividends but reinvested back into the company.

Is retained earnings a debit or credit?

Begin the statement by stating the opening balance and retained earnings amount carried over from the previous fiscal year’s end. Opening with the correct balance is vital as it sets the groundwork for the subsequent calculations. We can find the net income for the period at the end of the company’s income statement (consolidated statements of income). Strong financial and accounting acumen is required when assessing the financial potential of a company. Unappropriated retained earnings have not been earmarked for anything in particular.

Five-step process on how to prepare a statement of retained earnings

It also shows how much these retained earnings have been affected by dividend payments or other shareholder distributions. Retained earnings are a key retained earnings statement component of a company’s equity on the balance sheet. They are typically found in the equity section, which is located at the bottom half of the balance sheet.